Parler

Parler Gab

Gab

- JPMorgan Chase will update its Code of Conduct by late July to explicitly prohibit debanking based on religious or political affiliations, addressing politicization in financial services.

- The policy change follows pressure from the Alliance Defending Freedom (ADF) and a shareholder proposal from Bowyer Research.

- JPMorgan has faced criticism for debanking conservative and religious groups, raising doubts about the sincerity of its new policy.

- A 2024 Congressional investigation exposed systemic misuse of the banking system to target conservatives, underscoring the need for reform.

- While a step forward, skepticism remains due to JPMorgan's past actions, requiring continued advocacy to ensure lasting protections.

A win for free speech or merely a PR stunt?

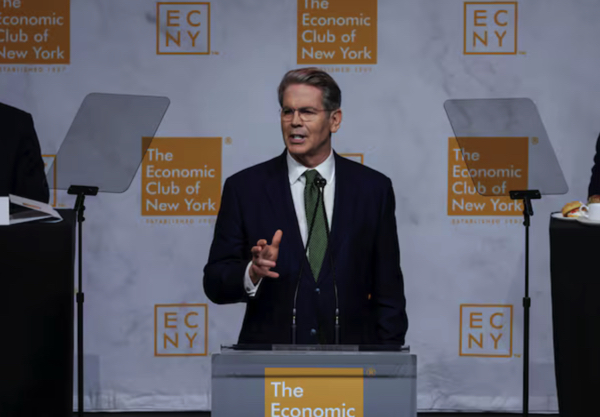

A Congressional investigation in December 2024 revealed alarming details about how the federal government has weaponized the banking system to surveil and target Americans with conservative viewpoints. The report, titled "Financial Surveillance in the United States: How the Federal Government Weaponized the Bank Secrecy Act to Spy on Americans," exposed how banks were instructed to flag transactions containing keywords like "Trump" and "MAGA" as potential indicators of "domestic terrorism." Even purchasing a Bible or exercising Second Amendment rights was enough to draw suspicion. This systemic overreach, facilitated by the Bank Secrecy Act, underscores the extent to which financial institutions have been co-opted as tools of political suppression. JPMorgan Chase CEO Jamie Dimon has consistently denied that the bank engages in debanking based on political or religious views. Yet, the bank's actions tell a different story. The recent policy change, while commendable, feels less like a genuine commitment to fairness and more like a calculated response to mounting legal and public pressure. As Tedesco noted, "[The bank's] good-faith negotiations and willingness to listen to its shareholders should encourage us all." However, the bank's history suggests that its newfound commitment to neutrality may be fleeting, especially if the political winds shift again. JPMorgan Chase, as the nation's largest bank, sets the standard for the financial industry. Its decision to adopt these protections could inspire other institutions to follow suit. Yet, the fight is far from over. Debanking remains a global phenomenon, with governments and financial institutions worldwide using access to banking services as a weapon against dissent. For now, JPMorgan Chase's policy change is a win for free speech and religious liberty. But as history has shown, vigilance is essential. Without continued pressure from advocacy groups like ADF and a watchful public, the gains made today could easily be undone tomorrow. The battle against debanking is not just about protecting bank accounts – it's about safeguarding the fundamental rights that define a free society. Visit Biased.news for more similar stories. Watch this Fox Business report about JPMorgan Chase ending its policy of debanking customers based on political or religious grounds. This video is from the TrendingNews channel on Brighteon.com.More related stories:

Major banks debanking Christians. National Australia Bank now debanking customers for "mean" speech. DEBANKING SPREE: UK banks are closing more than 1,000 accounts a day with little explanation. Sources include: ReclaimTheNet.org LifeNews.com ArmstrongEconomics.com Brighteon.comHillary Clinton calls for THOUGHT POLICE, echoing her persistent crusade for censorship

By Ramon Tomey // Share

A return to common sense: Corporate sponsors ditch San Francisco Pride Parade 2025

By Ramon Tomey // Share

Columbia University student self-deports following visa revocation over pro-Hamas protests

By Laura Harris // Share

U.S. declares South African ambassador PERSONA NON GRATA

By Ava Grace // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share