Parler

Parler Gab

Gab

- U.S. Treasury Secretary Scott Bessent is steering the Financial Stability Oversight Council (FSOC) away from "politically driven" oversight, such as environmental, social and governance (ESG) factors, toward prioritizing material financial risks and economic growth. This marks a departure from the previous administration’s emphasis on reputational and ESG-related risks.

- Bessent’s approach aims to reduce regulatory burdens, empower the private sector and enhance bank lending, particularly to small and regional banks. While conservatives applaud the move as a correction to bureaucratic overreach, critics warn it could undermine financial stability and efforts to address climate change and social justice.

- The administration is cutting federal bureaucracy, exemplified by the Small Business Administration’s (SBA) plan to reduce its workforce by 43%. Supporters argue this refocuses agencies on core missions, but critics fear it could weaken support for small businesses, especially during economic crises.

- Bessent acknowledges a potential economic slowdown during a "detox period" as the economy shifts from government dependency to private-sector-driven growth. He remains confident that deregulation will ultimately spur private-sector lending, job creation and innovation.

- The administration’s deregulatory agenda has reignited debates over the role of government in financial regulation, with conservatives viewing it as necessary for growth and critics seeing it as a risky gamble. The success of this approach hinges on balancing economic growth with financial stability and addressing long-term challenges like climate change and social equity.

A new vision for financial oversight

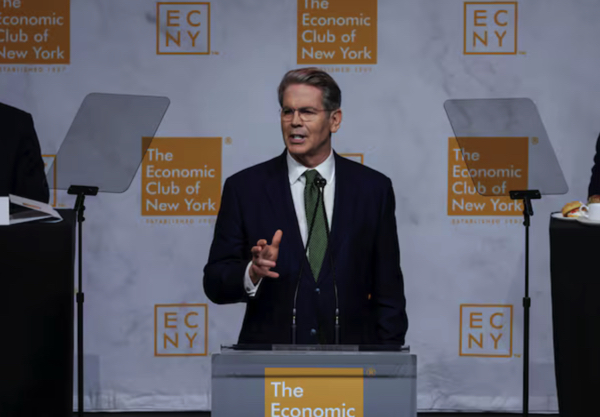

At a recent FSOC meeting held in executive session, Bessent outlined his vision for a streamlined regulatory framework that prioritizes material financial risks over what he describes as excessive focus on social and environmental concerns. “We need to unshackle the regulated banking system and refocus financial oversight on material risks rather than politically-driven agendas,” Bessent declared, echoing themes from his earlier speeches and interviews. This shift marks a stark departure from the previous administration’s emphasis on reputational risk and environmental, social and governance (ESG) factors. Critics of the prior approach argue that it stifled innovation and burdened businesses with unnecessary compliance costs. Bessent’s agenda, however, seeks to empower the private sector by reducing regulatory hurdles and enhancing bank lending to small and regional banks. “We need our financial regulators singing in unison from the same song sheet,” Bessent said during a speech at the Economic Club of New York. “To be clear, this does not mean consolidation of agencies, but coordination via Treasury, such that our regulators work in parallel with each other and industry.”The battle over ESG and DEI

The Trump administration’s push to refocus financial oversight has drawn sharp criticism from Democrats and progressive groups, who argue that the move undermines efforts to address climate change, social justice and corporate accountability. For years, Democrats have sought to use financial regulation to advance ESG and diversity, equity and inclusion (DEI) goals, often through non-legislative channels. Bessent’s approach, however, signals a clear rejection of these priorities. “The administration’s efforts to bolster Treasury market resilience and enhance coordination on cybersecurity risks reflect its focus on safeguarding the core financial infrastructure without stifling economic activity,” one observer noted. This ideological clash is not new. The debate over the role of government in regulating private enterprise dates back to the New Deal era, when Franklin D. Roosevelt’s administration expanded federal oversight to stabilize the economy after the Great Depression. In recent decades, however, conservatives have argued that such oversight has become overly burdensome, stifling innovation and economic growth.Streamlining government: A double-edged sword?

The administration’s deregulatory agenda extends beyond financial oversight. The Small Business Administration (SBA), for example, recently announced plans to reduce its workforce by 43%, cutting approximately 2,700 positions. SBA Administrator Kelly Loeffler framed the move as a necessary step to refocus the agency on its “core missions” of small business promotion, loan guarantees and disaster assistance. “Just like the small business owners we support, we must do more with less,” Loeffler said in a press release. “The SBA was created to be a launchpad for America’s small businesses by offering access to capital, which in turn drives job creation, innovation and a thriving Main Street. But in the last four years, the agency has veered off track—doubling in size and turning into a sprawling leviathan plagued by mission creep, financial mismanagement and waste.” While conservatives applaud these efforts to shrink the federal bureaucracy, critics warn that such cuts could undermine the government’s ability to support small businesses, particularly in times of economic crisis. The SBA’s pandemic-era Paycheck Protection Program (PPP), for instance, was widely credited with helping millions of businesses stay afloat during the COVID-19 lockdowns.A detox period for the economy?

Bessent’s vision for a private-sector-driven economy has also raised questions about the potential short-term costs of transitioning away from government dependency. In a recent CNBC interview, Bessent acknowledged that the economy may slow during this “detox period” as it shifts from public to private spending. “The market and the economy have just become hooked, and we’ve become addicted to this government spending,” Bessent said. “There’s going to be a detox period.” Despite these concerns, Bessent expressed confidence that the administration’s deregulatory policies would ultimately unleash private-sector growth. “We are going to have safe and sound regulation to get our banking system going again,” he said. “So the banks should be generating loans to private companies. Employment should be from private companies, not from government, and I’m confident, if we have the right policies, it’ll be a very smooth transition.”A golden age or a risky gamble?

As the Trump administration continues to reshape financial regulation and streamline government agencies, the question remains: Will this new approach usher in a golden age of economic growth, or will it leave the financial system vulnerable to instability and waste? Either way, the path we were on was unsustainable, so change was inevitable. For conservatives, Bessent’s agenda represents a much-needed correction to years of bureaucratic overreach and politically motivated oversight. For critics, however, it is a risky gamble that prioritizes short-term gains over long-term stability. One thing is certain: The battle over the role of government in financial regulation is far from over. As Bessent and his allies push forward with their deregulatory agenda, they will face fierce opposition from those who believe that government oversight is essential to safeguarding the economy and promoting social justice. In the end, the success or failure of this new approach will depend on whether it can deliver on its promise of growth without sacrificing stability—a challenge that will shape the future of American prosperity for years to come. Sources include: Breitbart.com Pymnts.com Reuters.comTrump imposes 25% tariffs on auto imports

By Laura Harris // Share

Trump imposes 25% tariff on nations buying Venezuelan oil

By Laura Harris // Share

We are closer to all-out war in Europe, in Asia, and in the Middle East than most people realize

By News Editors // Share

Trump’s USDA policies drive egg prices down nearly 60%

By Ava Grace // Share

The great crypto power struggle: How technocrats and governments are reshaping global finance

By Willow Tohi // Share

Trump administration reportedly preparing for military strikes on Iran, raising fears of escalation

By Finn Heartley // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share