Parler

Parler Gab

Gab

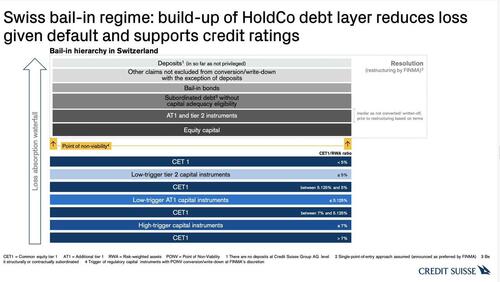

As shown in the Credit Suisse presentation chart below, in a typical writedown scenario, shareholders are the first to take a hit before AT1 bonds face losses. That’s why the decision to write down the bank’s riskiest debt — rather than its shareholders — provoked a furious response from some of the bondholders.

As shown in the Credit Suisse presentation chart below, in a typical writedown scenario, shareholders are the first to take a hit before AT1 bonds face losses. That’s why the decision to write down the bank’s riskiest debt — rather than its shareholders — provoked a furious response from some of the bondholders.

“This just makes no sense,” said Patrik Kauffmann, a fixed-income portfolio manager at Aquila Asset Management, who holds Credit Suisse CoCos. “Shareholders should get zero” because “it’s crystal clear that AT1s are senior to stocks.”

“This just makes no sense,” said Patrik Kauffmann, a fixed-income portfolio manager at Aquila Asset Management, who holds Credit Suisse CoCos. “Shareholders should get zero” because “it’s crystal clear that AT1s are senior to stocks.”

— Sean Tuffy (@SMTuffy) March 20, 2023As noted last night, the wipeout of 16 billion francs ($17.2 billion) of Credit Suisse’s so-called AT1 bonds is the biggest loss yet for Europe’s $275 billion market in these securities, which were created after the financial crisis to ensure losses would be borne by investors not taxpayers. Realizing that the chaos and fury among AT1 investors could spark the next leg of market contagion, on Monday morning European regulators rushed to reassure investors that shareholders should face losses before bondholders after the takeover of Credit Suisse Group AG wiped the bank’s Additional Tier 1 debt while preserving over $3 billion in equity value. Junior creditors should bear losses only after equity holders have been fully wiped out, according to a joint statement from the Single Resolution Board, the European Banking Authority and the ECB Banking Supervision, who apparently were not consulted on Sunday during the whirlwind decisions that preserved some equity value at CS while wiping out its entire AT1 tranche. Other European officials also weighed in. ECB Governing Council member Ignazio Visco said at an event in Milan that that regulators have the tools to deal with liquidity problems, but there are no issues currently. Italy’s Finance Minister Giancarlo Giorgetti said the risk for Italian banks is “not significant.” He added that he was “surprised” by the Swiss decision to prioritize shareholders over some bondholders. As Bloomberg notes, the clauses that led to the bonds being marked to zero aren’t common. Only the AT1 bonds of Credit Suisse and UBS Group AG have language in their terms that allows for a permanent write-down and most other banks in Europe and the UK have more protections, according to Jeroen Julius, a credit analyst at Bloomberg Intelligence. If the AT1 new-issue market reopens, equity conversion may become the dominant loss-absorption mechanism to reassure investors that they won’t be wiped out ahead of shareholders, BI’s Julius said. Yet, judging by the market action, investors aren’t sticking around to find out. All kinds of risky bank debt tumbled on Monday and analysts predicted far-reaching consequences to Europe’s funding market. The market for new AT1 bonds will likely go into deep freeze, traders said. Perpetual notes issued by Deutsche Bank AG, Unicaja Banco SA, Raiffeisen Bank International and BNP Paribas SA all dropped by more than 10 points on Monday. Deutsche Bank’s £650 million ($792 million) 7.125% note dropped as much as 17 pence to about 64, its biggest-ever one-day decline. Most other European lenders’ Additional Tier 1 (AT1) notes fell to record lows. Read more at: ZeroHedge.com

By Arsenio Toledo // Share

Pentagon demands $842B budget as America prepares for war against China

By Belle Carter // Share

Zelensky admits Ukraine already OUT OF AMMO – another begging spree in the works

By Ramon Tomey // Share

Marxist group FAILS to shutter South African economy

By Belle Carter // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share