Parler

Parler Gab

Gab

- India has imposed a temporary 12 percent tariff on five categories of steel imports for 200 days to curb low-cost shipments – primarily from China, South Korea and Japan.

- Steel imports hit a nine-year high (9.5 million metric tons in 2024–25), with 78 percent from China, South Korea and Japan, straining India's domestic steel industry and smaller mills.

- The move aligns with broader protectionist trends, mirroring U.S. and EU actions against Chinese steel dumping, but risks retaliation, especially from Beijing.

- Domestic steel giants (e.g., Tata Steel, JSW) support the duty as vital for protecting against "unfair" imports, while critics warn of higher input costs harming smaller manufacturers and export competitiveness.

- While the tariff may offer short-term relief to local producers, it could escalate trade conflicts and undermine India’s manufacturing growth.

- Hot rolled coils, sheets and plates

- Hot rolled plate mill plates

- Cold rolled coils and sheets

- Metallic coated steel coils and sheets

- Color coated coils and sheets

India's steel tariffs: Self-reliance or trade turmoil?

Historically, steel has been a geopolitical flashpoint. The U.S. and the European Union have long accused China of dumping subsidized steel, triggering waves of tariffs since the early 2000s. Notably, the 12 percent tariff arrives amid broader calls in the U.S. to penalize nations perceived as undermining fair trade. These include demands to leverage tariffs against countries refusing to repatriate illegal immigrants. New Delhi's action echoes this pattern, but risks provoking Beijing – which could retaliate against Indian exports like pharmaceuticals or textiles. Indian Steel Minister H.D. Kumaraswamy nevertheless framed the tariff as essential for India's self-reliance. "The move will provide critical relief to domestic producers – especially small- and medium-scale enterprises, who have faced immense pressure from rising imports," he said. The minister added that the levy "will help restore market stability and reinforce the confidence of the domestic industry." Major steel producers like Tata Steel and JSW Steel welcomed the duty as a lifeline against "unfair" imports. Naveen Jindal of the Indian Steel Association praised the government for defending domestic producers, citing Prime Minister Narendra Modi’s "Atmanirbhar Bharat" (self-reliant India) initiative. However, critics argue that such measures distort markets and could slow India's manufacturing growth. Smaller manufacturers and engineering exporters warn that higher input costs could cripple their competitiveness abroad. As trade barriers multiply, the long-term impact remains uncertain. While the tariff may offer temporary relief to Indian steelmakers, it risks escalating into a broader trade conflict. Head over to MarketCrash.news for more similar stories. Watch this Fox News report about the second Trump administration using tariff negotiations to isolate China. This video is from the NewsClips channel on Brighteon.com.More related stories:

India braces for Trump's reciprocal tariffs as U.S. seeks fair trade deals. Indian refiners seek alternatives to Russian oil after Trump tariff threat. Trump administration engages 130 nations in trade talks to reshape global tariffs amid China tensions. Sources include: TheNationalPulse.com Finance.Yahoo.com MoneyControl.com Brighteon.comBy Lance D Johnson // Share

Pakistan claims India is planning a strike over Kashmir tensions

By Cassie B. // Share

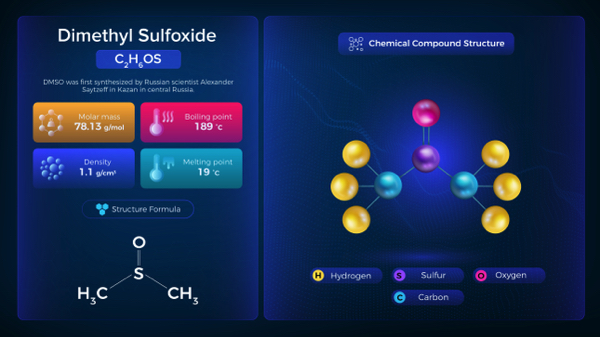

A comprehensive look at DMSO’s potential in cancer treatment

By Ramon Tomey // Share

Dill: An ancient superfood with modern healing powers

By Ava Grace // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share