Parler

Parler Gab

Gab

- The CTA, aimed at combating money laundering, has faced significant implementation issues since its enactment in 2021. Despite a February 2025 court decision reinstating the law, the Financial Crimes Enforcement Network (FinCEN) announced a non-enforcement policy for the March 21, 2025, filing deadline, creating uncertainty for businesses.

- The CTA has been poorly received by small businesses, with less than 13% of covered entities filing the required reports. Compliance rates are even lower in states like Ohio and Pennsylvania, highlighting the law's complexity and the resource constraints faced by small businesses.

- The CTA has been criticized for targeting law-abiding businesses while failing to deter criminals. Brian Reardon, a small business advocate, described the situation as a "regulatory train wreck," and there are currently seven lawsuits challenging the law's constitutionality, with one case advancing to the 11th Circuit Court.

- Efforts to delay the CTA's reporting requirements have gained bipartisan support, with a House bill passing overwhelmingly but stalled in the Senate. FinCEN has signaled plans to revise the CTA's rules and solicit public comments, indicating a potential shift towards more manageable regulations for small businesses.

- The CTA's implementation challenges reflect a larger trend of increasing regulatory burdens on small businesses, which face disproportionately high costs compared to larger firms. The law's fate could significantly impact entrepreneurship and economic growth, with potential consequences for millions of business owners.

A rollercoaster of deadlines and enforcement

The CTA, enacted in 2021, requires businesses to report beneficial ownership information (BOI) to FinCEN, ostensibly to prevent criminals from using shell companies to hide illicit activities. However, the law’s implementation has been anything but smooth. On February 18, 2025, a U.S. District Court in Texas lifted its injunction on the CTA’s BOI reporting requirements, reinstating the law and setting a new filing deadline of March 21, 2025. Just nine days later, FinCEN issued a stunning announcement: It would not enforce the March 21 deadline. In a press release, FinCEN stated, “We will not issue any fines or penalties or take any other enforcement actions against any companies based on any failure to file or update beneficial ownership information (BOI) reports pursuant to the Corporate Transparency Act by the current deadlines.” This effectively made compliance voluntary—at least for now. The Treasury Department followed up on March 2, 2025, with a press release suggesting that future regulations might exempt U.S.-owned businesses from the CTA’s reporting requirements, focusing enforcement efforts instead on foreign-owned entities. This potential shift underscores the growing recognition that the CTA, as currently structured, places an undue burden on American small businesses.A regulatory train wreck in the making

The CTA’s rocky rollout has been a disaster for small businesses, many of which are unaware of the law’s requirements or lack the resources to comply. According to FinCEN data, less than 13% of covered entities have filed the necessary reports. In states like Ohio and Pennsylvania, compliance rates are even lower, hovering at 5% and 4%, respectively. Brian Reardon, a small business advocate, aptly described the situation as a “regulatory train wreck.” In an October 2024 op-ed, Reardon noted, “The failure to file is a felony. Under the passionate leadership of [Vice President Kamala Harris], the federal government is moving forward on a policy that will turn millions of small business owners into felons by the end of the year.” Reardon’s critique highlights a fundamental flaw in the CTA: It targets law-abiding business owners while doing little to deter actual criminals. As he pointed out, “The bad guys are not going to self-report their crimes, and the significant fines and jail time accompanying noncompliance are threatening to law-abiding business owners only.”A path forward

The CTA’s future remains uncertain, with multiple legal and legislative challenges underway. Seven lawsuits are currently challenging the law’s constitutionality, with one case recently advancing to oral arguments in the 11th Circuit Court. These legal challenges argue that the CTA oversteps federal authority and imposes an unreasonable burden on small businesses. On the legislative front, efforts to delay the CTA’s reporting requirements have gained bipartisan support. A bill introduced by Rep. Zach Nunn (R-IA) passed the House with overwhelming support (420-1) but remains stalled in the Senate, where Banking Committee Chairman Sherrod Brown (D-OH) has yet to bring it to a vote. Meanwhile, FinCEN has signaled its intention to revise the CTA’s rules, with an interim final rule expected by March 21, 2025. The agency has also pledged to solicit public comments on potential changes, a move that could provide much-needed relief for small businesses.Why this matters: A historical perspective

The CTA’s tumultuous journey is emblematic of a broader trend: the growing regulatory burden on American small businesses. Over the past two decades, federal regulations have increased dramatically, with small businesses bearing a disproportionate share of the costs. According to a 2020 study by the National Association of Manufacturers, small businesses face regulatory costs of $12,000 per employee annually—nearly double the cost for larger firms. This regulatory onslaught has stifled innovation and entrepreneurship, key drivers of economic growth. As Reardon noted, “If the vice president really were passionate about the interests of small businesses, she would ask FinCEN to suspend the filing deadline pending the resolution of these court cases and further action by Congress.” The CTA’s fate will have far-reaching implications for small businesses and the broader economy. If the law is implemented as written, millions of business owners could face felony charges for failing to comply with complex reporting requirements. Conversely, a thoughtful revision of the CTA could strike a balance between combating financial crime and protecting small businesses from undue regulatory burdens. For now, small business owners are left in limbo, waiting for clarity from FinCEN, the courts and Congress. In the meantime, one thing is clear: The CTA, in its current form, is a cautionary tale of how well-meaning legislation can go awry when it fails to consider the realities of small business ownership. As the debate over the CTA continues, one can only hope that policymakers will heed the lessons of history and prioritize the needs of America’s small businesses — the backbone of our economy. Sources include: MorganLewis.com WashingtonExaminer.comUSAID staff ordered to DESTROY EVIDENCE in mass document purge amid DOGE investigations

By Lance D Johnson // Share

Kash Patel’s crusade: Exposing the J6 pipe bomb hoax and restoring trust in the FBI

By Willow Tohi // Share

When dissent becomes a crime: The war on political speech begins

By News Editors // Share

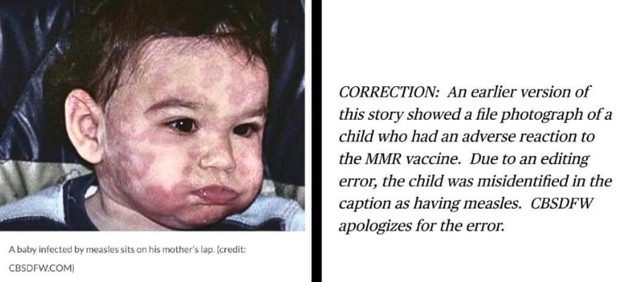

Grieving family’s pain exploited: How vaccine zealotry crossed the line in West Texas

By Willow Tohi // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share