Parler

Parler Gab

Gab

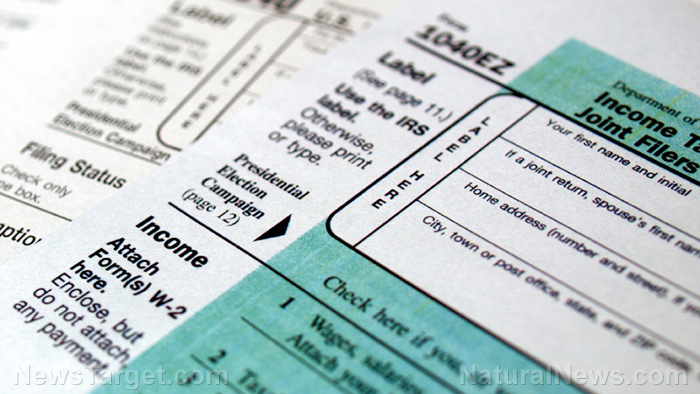

"Littlejohn stole thousands of individuals' tax returns and tax information for the purpose of publicizing that information in service of his own political agenda," said Department of Justice Public Integrity Section Chief Corey Amundson in a court filing. "He fully understood, indeed intended, that his disclosures would damage his victims’ reputations and hoped that such reputational damage would affect our nation’s political process."

Littlejohn uses "moral belief" to justify leaking tax documents

Reyes noted that Littlejohn seemed to have a "sincere moral imperative" with his actions of leaking the tax documents of various personalities. Nevertheless, she stressed that he was not above the law. In a brief address to the court before his sentencing, Littlejohn said he "acted out of a sincere but misguided belief that I was serving the public." He ultimately acknowledged that his "actions undermined the fragile trust we place in government." Lisa Manning, one of Littlejohn's attorneys, argued that her client acted "out of a deep, moral belief that the American people had a right to know the information, and sharing it was the only way to effect change." Despite acknowledging the inexcusable nature of Littlejohn's conduct, she and the other defense lawyers highlighted that a "strong message of general deterrence" had already been sent to the public. According to a court filing by Manning, Littlejohn was disturbed that Trump refused to release his tax returns even after being elected president despite a 50-year tradition of disclosure. The IRS contractor eventually gained access to 15 years' worth of the former president's tax returns. Littlejohn then turned over these tax returns to the NYT in August 2019, with the paper publishing articles about these documents more than a year later in September 2020. But the former IRS contractor did not stop there. As he learned that billionaires typically paid lower effective tax rates than average American taxpayers, he downloaded tax returns for the wealthiest 500 Americans during the same 15-year period, the filing stated. These filings were then forwarded to ProPublica, which proceeded to publish stories about these documents in September 2020. (Related: IRS consultant charged with leaking Trump's tax returns to media.) He contended that taxpayers deserved to know about the ease with which the wealthy could avoid paying into the system. Littlejohn expressed his belief that Americans make their best decisions when properly informed, acknowledging that he anticipated the legal consequences of his actions. Head over to BigGovernment.news for more stories like this. Watch Judicial Watch President Tom Fitton as he talks about why the probe on Trump's tax returns amounts to unprecedented abuse by the IRS below. This video is from the NewsClips channel on Brighteon.com.More related stories:

INSANITY: NYT hit piece on Donald Trump demonstrates stunning financial illiteracy of the left... money for nothing and chicks for free. Trump tax return "bombshell" BACKFIRE… Trump paid $38M in taxes in 2005… MSNBC becomes Comedy Central. Ex-IRS consultant took job with intention of stealing Trump's tax returns: DOJ. Sources include: Mirror.co.uk MSN.com Brighteon.comTexas AG Paxton: Biden federalizing Texas National Guard would be a disastrously BAD DECISION

By Kevin Hughes // Share

Ray McGovern: NEOCONS and WARMONGERS in Biden admin are pushing U.S. into war with Iran

By Kevin Hughes // Share

Biden gives game plan away: Senate bill precursor to amnesty for illegals

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share