Parler

Parler Gab

Gab

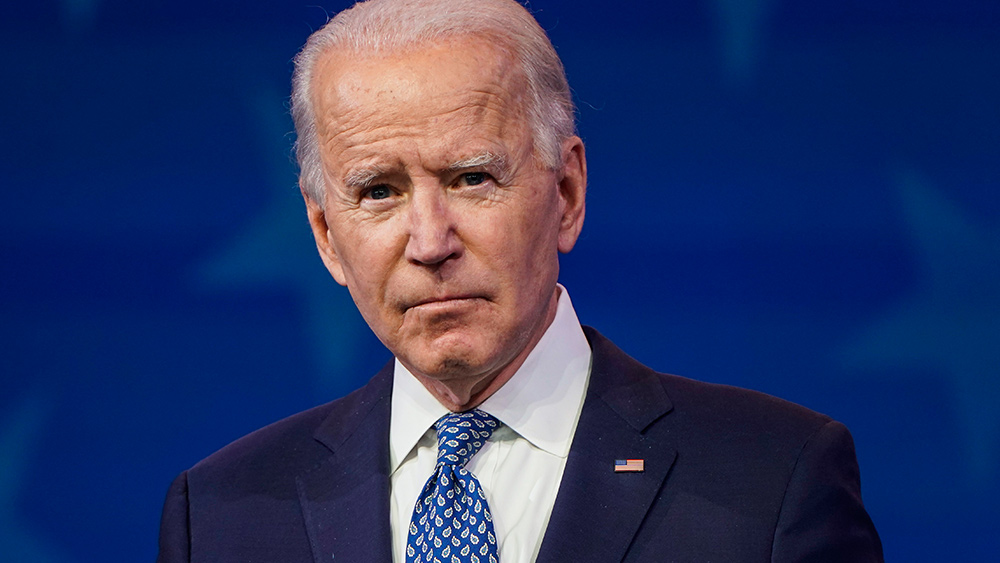

Instead the regulators offered solutions that bail out even uninsured bank depositors and other banks at unknown costs that Mr. Biden isn’t acknowledging. -WSJKevin Hassett, former Chairman of the Council of Economic Advisers under Trump, told Fox Business that "there were buyers who were willing to step in & buy [SVB, but] the radicals at the @FDICgov basically weren’t going to allow that to happen ... the Biden Admin had a whitelist of companies that were allowed to buy the failed bank & companies that weren’t." "If this is true," said Grabien founder Tom Elliott, "then this is another Biden scandal."

While most banks have hedged their interest-rate risk and diversified their deposits, SVB and Signature bank did not - yet, President Biden is of course blaming former President Donald Trump for modifying certain rules from the 2010 Dodd-Frank act in the 2018 bipartisan banking law, which raised the threshold to classify financial institutions as 'systemically important' (Sifi) from $50 billion in assets to $250 billion. Yet, as the Journal notes, Barney Frank, co-author of Dodd-Frank, thinks that's BS, as the entire point of the 2018 legislation was to reduce costly compliance on mid-size banks so they could be more competitive with the giants - the latter of which benefit from a lower cost of funding due to their implicit government backstop. In short, the Dodd-Frank legislation was driving more deposits to large banks, while mid-size banks forced to comply with the same regulations were at a disadvantage. The 2018 law did not excuse mid-sized banks from performing quarterly liquidity stress tests to ensure they could withstand "adverse market conditions," and "combined market and idiosyncratic stresses," such as interest-rate shocks. Mid-sized banks must also maintain a liquidity buffer of "highly liquid assets" such as Treasurys and MBS. Something deeper afoot? Biden's blame game aside, crypto VC Nic Carter has some very interesting thoughts on what went down in regards to the shuttering of Signature Bank, calling it a "Colossal scandal."If this is true, and the WSJ is also reporting it, then this is another Biden scandal. Rather than letting the free market resolve a somewhat ordinary bank collapse, they used the opportunity to nationalize SVB, using tax money to ensure their campaign donors were made whole. https://t.co/TKtvR0eUQQ

— Tom Elliott (@tomselliott) March 14, 2023

Continued; Heard this independently from other sources as well. I suspected as much last night but confirmed today. Signature was executed last night not due to any runs but as a political scalp, intended to be veiled by the fog of war. Apparently even FDIC was surprised when it was dropped into their hands. The claimed justification was Signatures Signet product, which was perceived to be "systemic." My conclusion is that politicians like Liz Warren together with regulatory bodies fragilized crypto banks and encouraged runs against them, then used withdrawals as a pretext to close them down What was meant to be a surgical operation became a massive banking crisis.Dear God. Barney Frank openly admits that Signature was arbitrarily shuttered despite no insolvency because regulators wanted to kill off the last major pro-crypto bank. Colossal scandal https://t.co/Sa25w6Au7bpic.twitter.com/gLuiybHepS

— nic carter ? (@nic__carter) March 13, 2023

Read more at: ZeroHedge.comLastly, if you don't think Barney Frank has a reliable read of the situation - the 'Frank' in Dodd Frank, former chair of the House Financial Services Committee, I can't help you

— nic carter ? (@nic__carter) March 13, 2023

Feds using banking crisis to usher in central bank digital currency, experts warn

By News Editors // Share

Dr. Robert Malone: Top universities worldwide are now puppets of the World Economic Forum

By News Editors // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share